iowa inheritance tax return instructions

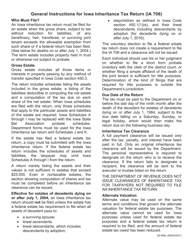

Inheritance Tax Return Instructions 60-066 General Instructions for Iowa Inheritance Tax Return IA 706 Who Must File. IA 706 Inheritance Tax Return Inheritance Iowa Inheritance Tax Consent and Waiver of Lien Inheritance Inheritance Tax Application for Extension of Time to File Attachmnet 12 - Forms.

Transfer On Death Tax Implications Findlaw

Iowa Inheritance Tax Schedule J 60-084.

. Probate Form for use. Track or File Rent Reimbursement. This document is found on the website of the government of Iowa.

The following Inheritance Tax rates will apply to a decedents beneficiary who is a. Use Get Form or simply click on the template preview to open it in the editor. Track or File Rent Reimbursement.

Report Fraud. A decedents net estate must be worth more than 25000 before the inheritance tax is applicable. Assuming an item is otherwise deductible for income and inheritance tax purposes the no double deduction rule has the following applications for Iowa income and inheritance tax.

The tax return along with copies of the deceased persons will trust and federal. Inheritance IA 706 Return 60-008. Learn About Property Tax.

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. Track or File Rent Reimbursement. Those exempt from the Iowa inheritance tax.

Register for a Permit. If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. A return merely listing the.

Read moreabout IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. Read moreabout Inheritance Deferral of Tax 60-038. Completing the authorization on page 2 will authorize the.

The personal representative is required to designate on the return who is to receive the clearance. Exemptions From The Iowa Inheritance Tax. 0-12500 has an Iowa inheritance tax rate of 5.

Register for a Permit. If the return fails to. Iowa Inheritance Tax Schedule K 60-085.

Adopted and Filed Rules. An extension of time to file. Inheritance Deferral of Tax 60-038.

Change or Cancel a Permit. Tax return must be filed and tax paid by the last day of the ninth month after the death of the life tenant. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

Register for a Permit. Quick steps to complete and design 706 Iowa Inheritance Estate Tax Return Form online. Iowa InheritanceEstate Tax Return IA 706 Step 1.

Brother sister son-in-law daughter-in-law of the decedent. Learn About Sales. An Iowa inheritance tax return must be filed for an estate when the.

GENERAL INSTRUCTIONS FOR IOWA INHERITANCE TAX RETURN IA 706 The return must be filed and any tax due paid on all property coming into present possession and enjoyment. If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. Up to 25 cash back This terminates an automatic inheritance tax lien on property in the estate.

Inheritance tax clearance will be issued by the Department. Unlike federal estate taxes.

How To Create A Living Trust In Iowa Smartasset

Death And Taxes Nebraska S Inheritance Tax

How To Pay Inheritance Tax With Pictures Wikihow Life

10 Least Tax Friendly States For Retirees Kiplinger

Estate And Inheritance Taxes By State In 2021 The Motley Fool

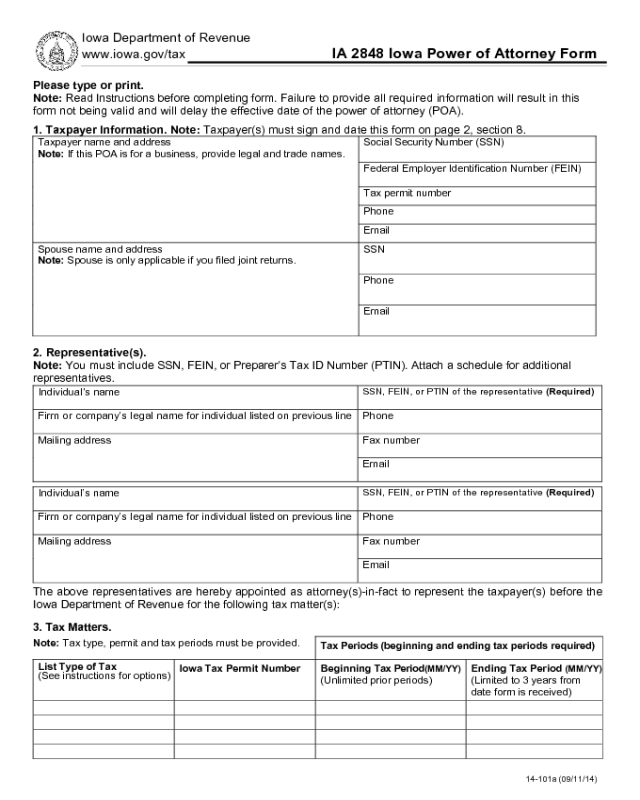

Sample Power Of Attorney Form Iowa Edit Fill Sign Online Handypdf

Appliction For Refund Of Inheritance Or Estate Tax Rev 1313 Pdf Fpdf Docx

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Acr Spr Practice Parameter For The Use Of Intravascular Iowa Pdf4pro

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

328 265 Tax Stock Photos Pictures Royalty Free Images Istock

Death And Taxes Nebraska S Inheritance Tax

:max_bytes(150000):strip_icc()/157404022-56aa10d45f9b58b7d000ac52.jpg)

Will You Have To Pay A State Tax On Your Inheritance

Tax Affordability Guide To Tax Restrictions And Breaks In 50 States

Download Instructions For Form Ia706 60 008 Iowa Inheritance Tax Return Pdf Templateroller

Pa Rev 1500 Ex 2006 Fill Out Tax Template Online

Michigan Inheritance Tax Explained Rochester Law Center

Senate Panel Votes To End Iowa Inheritance Tax Iowa Public Radio